| THIS WEEK AT SENTINEL SECURITY LIFE - ANNUITIES: PERSONAL CHOICE ANNUITY RATE ADJUSTMENTS EFFECTIVE 10/21

NEW SUITABILITY FORM REQUIRED FOR FLORIDA APPLICATIONS - LIFE: ALL TRUE STORIES - VIDEOS FOR YOU TO VIEW AND SHARE

- HEALTH: BEST MEDICARE SUPPLEMENT RATES IN PENNYLVANIA!

| |

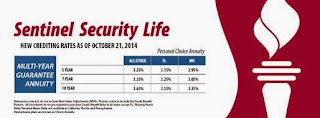

Sentinel Plan Annuity Products | Personal Choice Annuity - Rate decrease for 5, 7, and 10 year MYGA products Effective 10/21/2014, our Multi-Year Guarantee Annuity will experience a rate decrease of 10 basis points for the 5, 7, and 10 year products. Please see below timeline: - October 20, 2014 – Date applications must be signed to receive current rates. Applications must be signed by October 20, 2014 or before to receive the current crediting rates.

- October 21, 2014 – Date when new crediting rates take effect. Any applications signed on October 21, 2014 and later will receive the new crediting rates.

- October 27, 2014 – Date application must be received in Home Office to receive current rates. Applications signed by October 20, 2014 or earlier must be received in the Home Office by October 27, 2014 to receive the current crediting rates. We will accept faxed or e-mailed applications on October 27, 2014 if hard copies are received in the Home Office on October 28, 2014.

New Business E-mail: newbusiness@sslco.com New Business Fax: 888-433-4795 - December 5, 2014 – Date 45-day rate lock ends. All transfer and exchanges for any application signed on October 20, 2014 or earlier must be completed by December 5, 2014 in order to receive the current crediting rates.

PERSONAL CHOICE ANNUITY RATE SHEET - EFFECTIVE 10/21/2014

Annuities in Florida - Suitability and Disclosures in Annuity Contracts On October 1, 2014 the Florida Department of Financial Services (DFS) amended Florida Administrative Code Rule 69B-162.011, “Suitability and Disclosures in Annuity Contracts – Forms Required” (the Suitability Rule). As amended, the Suitability Rule change Annuity Suitability Questionnaire (Form DFS-H1-1980) and Disclosure and Comparison of Annuity Contract (Form DFS-H1-1981) to add questions addressing the additional factors to be considered under the revised statute.

The modified Rule and Forms become effective October 21, 2014, with no delayed effective date for the use of the new forms. These forms are available on our Producer Portal or by clicking the links below. You may continue using the forms in the existing printed application packs EXCEPT for these two new forms which are required to be sent with all Florida applications that are signed on October 21, 2014 or later. FLORIDA SUITABILITY FORM AND QUESTIONNAIRE DISCLOSURE AND COMPARISON OF ANNUITY CONTRACT |

|

| Sentinel Plan Life Products | All True Stories - Life Happens If you have some extra time, check out a few of these videos that lifehappens.org has put together. They are real life stories of people from all backgrounds, who understand the importance of life insurance. Share with your clients, your colleagues and your family to increase awareness for life insurance! TRUE STORIES - LIFE HAPPENS |

| Sentinel Plan Health Products |

|

| CONFIDENTIAL NOTICE: This message is intended only for the individual or entity to which it is addressed, and may contain information that is privileged, confidential, or exempt from disclosure under applicable law. If the reader of this message is not the intended recipient, or the employee or agent responsible for delivering the message to the intended recipient, you are hereby notified that any dissemination, distribution, or copying of this communication is strictly prohibited. |

|

|

|

Paul Rauch, Distribution Wholesaler

Life and Annuity Shop – An AmeriLife Company

3523 Palm Harbor Blvd.

Palm Harbor, Florida 34683

Phone: (888) 661-1999

Toll Free Fax: (800) 671-3047

paul@annuity1.com

![]()

![]()

![]()

![]()